The Falling Leaves, Drift by the Window

Destra Capital

October 30, 2024October is often a tough month for risk assets. Some of the stock market’s biggest sell offs in history have occurred in this first full month of fall in the northern hemisphere. Credit instruments often trade in sympathy with equities, if not in lock step occasionally. This October, bond prices generally fell like autumn leaves, as yields pushed up for a host of reasons.

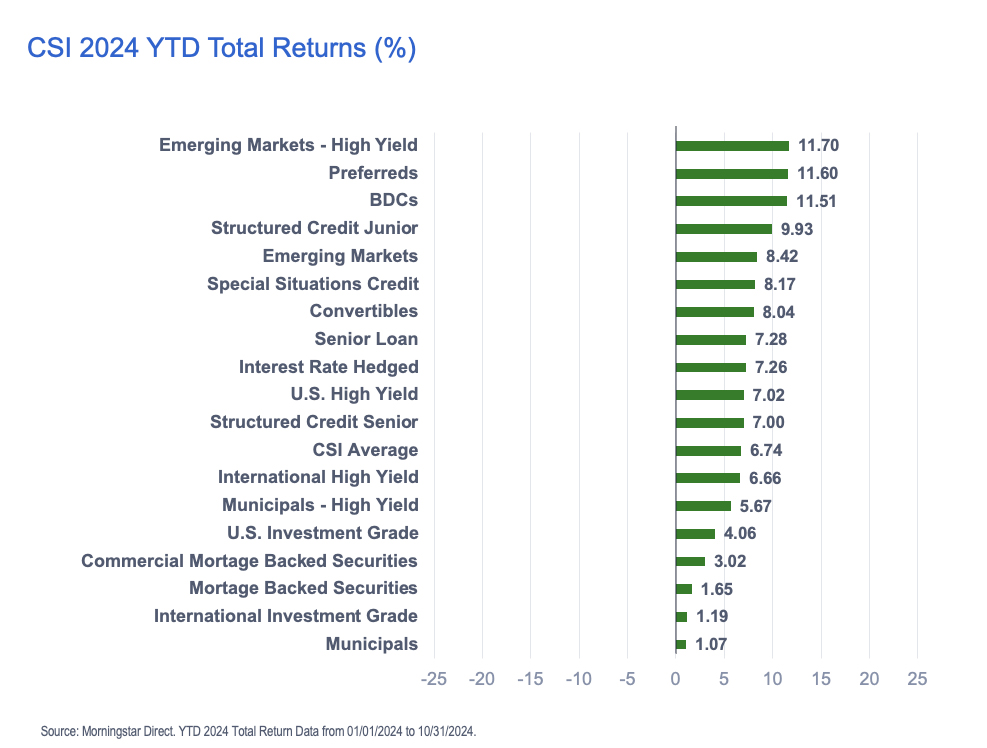

The Destra Credit Strategies Indicator (“CSI”) was negative/flat for the month as an average of the 18 underlying sub-strategies tracked, with 11 negative and only 7 positive constituents.

Market realities and political posturing certainly weighed on the minds of bond and credit investors throughout the month with International Investment Grade credit strategies down the most, followed by Mortgage Backed Securities , International High Yield and CMBS strategies also performed poorly.

October CSI Laggards

| International Investment Grade | -2.83% |

| Mortgage Backed Securities | -2.79% |

| International High Yield | -2.41% |

| Commercial Mortgage Backed Securities | -2.20% |

But not all the news and results across different credit strategies were negative for the month. Structured Credit Junior strategies performed well and were joined by BDC strategies as well.

October CSI Leaders

| Structured Credit Junior |

+1.33% |

| BDCs | +1.03% |

| Structured Credit Senior | +0.75% |

| Interest Rate Hedged | +0.73% |

For the year to date, the CSI was still solid green with all 18 sub-categories in positive territory. This is quite impressive and reflects the power of expectations perhaps more than fundamentals for credits. Expectations have been that inflation was subsiding, and the economy was slowing, perhaps even achieving a soft landing and that rates were going to fall. Certainly, the Fed’s 50 basis point move down reaffirmed the idea that rates overall could go lower. But something interesting happened on the way to a raging bull market in bonds…

The Path Less Travelled….

According to Bloomberg in the last days of October, “Swaps are pricing in a more than 80% chance that the central bank will cut rates by a quarter point on Nov. 7. But they also signal strong odds that it won’t shift at one of the next two meetings and will look to Chairman Jerome Powell for clues.”

Surprise, Surprise, Surprise!

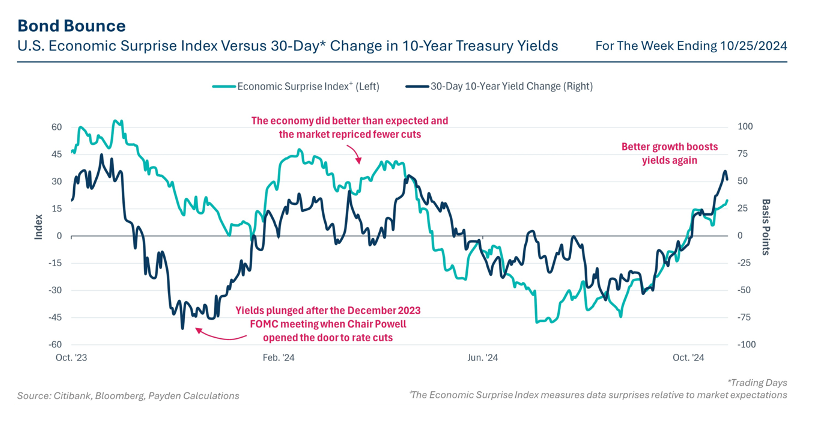

The fixed income and economics team over at Payden & Rygel pointed out in their investment note on October 25 th that the market overestimated how much the economy was slowing back during the summer. Remember in early August that some were breathlessly crying for emergency inter-meeting cuts to stave off financial disaster. Well, the US Economic Surprise Index pulled a “Gomer Pyle”, showing that there is more resiliency in the economy than perhaps many thought. And with it may come a different outlook for risk assets.

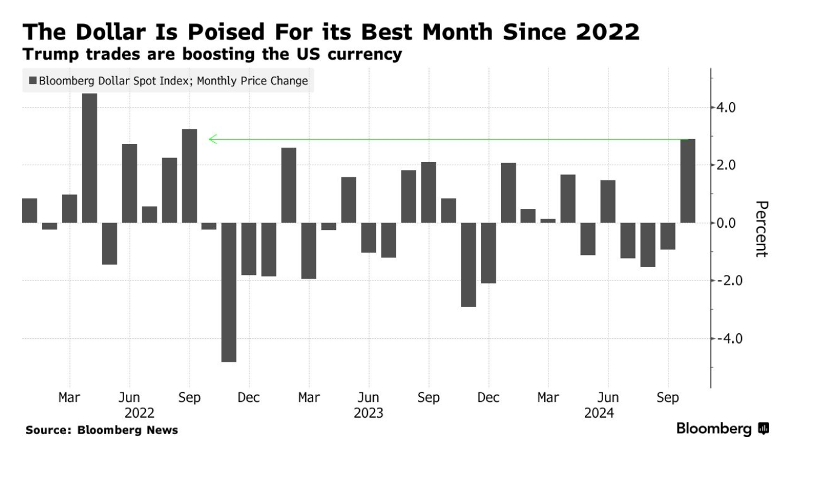

The Buck Didn’t Stop Here

Further complicating market trends, on October 24th, Naomi Tajitsu at Bloomberg pointed out that the Bloomberg Dollar Spot Index has rallied nearly 3% and is poised for its best month since 2022. A strong dollar complicates things for the economy and for credits.

Uh Oh, Better Call AAMCO

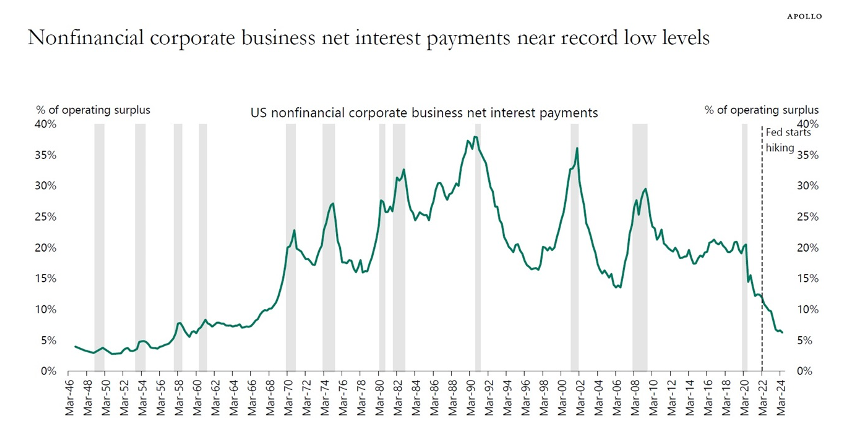

Apollo’s Chief Economist points out that the Fed rate increases that started several years ago did not have the same “transmission effect” through the economy that was historically expected. The same will be true now in the opposite direction as the Fed rates come down, because in aggregate, corporations moved dramatically to refinance at near zero rates over the last 5 years and thus have dramatically lowered the overall debt service they face.

Spending Like There’s No Tomorrow

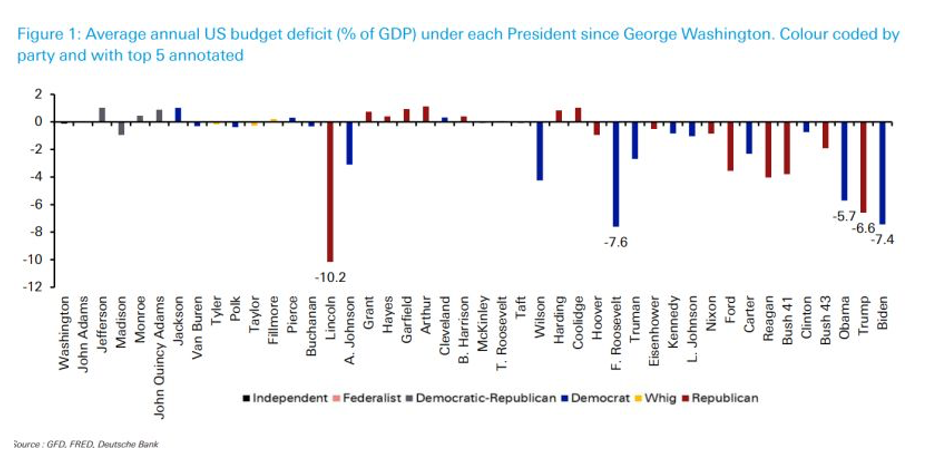

But while corporations may have used the zero-rate environment to get their financial houses in order, our beloved Federal government did not do the same. In fact, this great piece out from Deutsche Bank, using FRED data from the St Louis Fed, shows the average annual budget deficit under every President in US history.

Obama, Trump and Biden must collectively be so proud that they all made the “Top 5”.

Deficit Threat

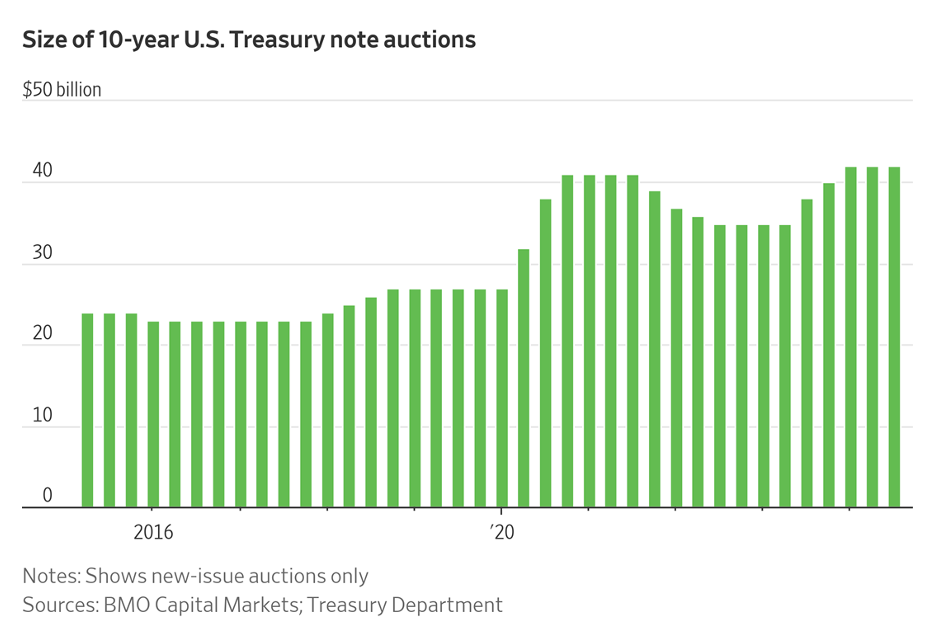

Joking aside, the issue of the rapidly expanding federal deficit is starting to reawaken the old guard of the bond world…..vigilantes. While they are not as vocal yet as they famously were back in ’93 & ‘94, their impact is being felt in some of the most important technical corners of the market, as noted in a recent Wall Street Journal post.

“The prospect of a rising federal deficit is fueling a sharp climb in bond yields, with investors betting a challenging fiscal situation might only get worse after the election. Treasury yields, which rise when bond prices fall, jumped Monday after a $69 billion government auction of 2-year notes attracted tepid demand from investors.”

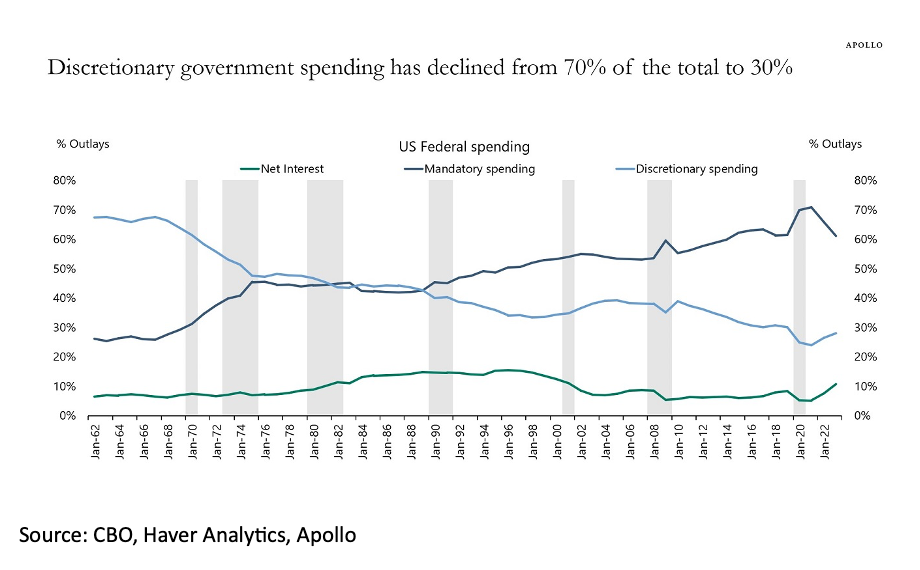

Structural Self Destruction

And the issue of deficits and their impact on markets and the economy are not going to get easier to solve going forward. For decades now Congress has shifted more and more spending to mandatory social programs, leaving less and less that is actually discretionary. The impact of this will be significant and very hard to navigate politically for years to come.

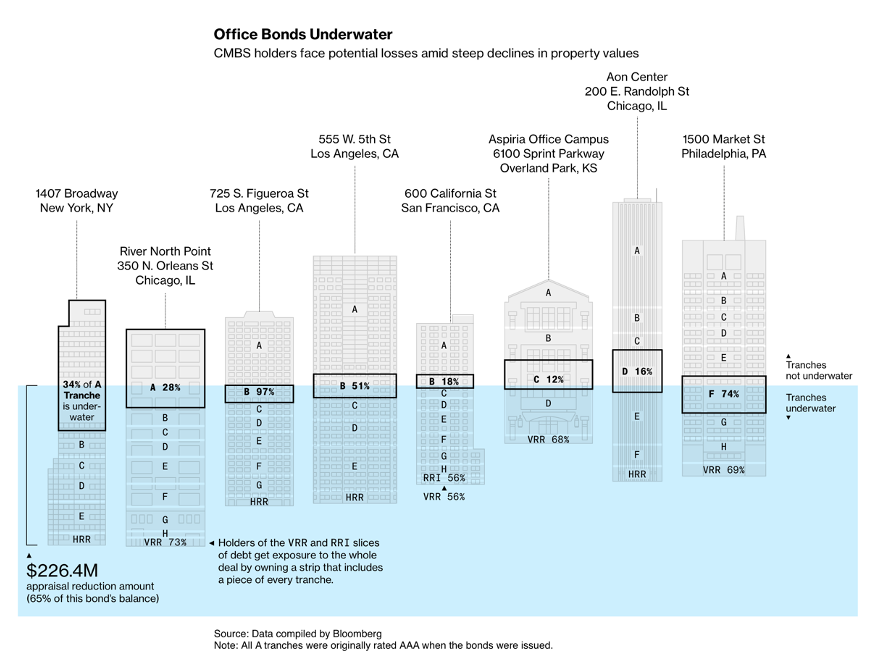

Commercial Distress (long read)

But don’t think that all the trouble in “bondville” is only to be found by the iron-clad securities issued with the full faith and backing of our rock solid, intrepid US government (insert sarcasm emoji here). No, there are other areas of concern as well.

We close October’s Credit Events newsletter with a link to a very interesting article from Bloomberg, about the distress creeping up the cap stack of some high profile CMBS properties. For those of you with a Bloomberg subscription, it is a must read. https://www.bloomberg.com/news/features/2024-10-28/commercial-real-estate-crisis-hits-aaa-rated-bonds-tied-to-office-buildings

The summary is that there is much to be distressed about in some of the most glamorous office properities across the nation. And the impact is not just being felt in Mezz and lower rated structured credits of real estate securities. It is pushing higher for a few specific issues, all the way to the top, breaching the AAA traches, something unheard of since the GFC.

It certainly has been a spooky exercise to review bonds and credits here at the end of October. “Jerome Powell” was the winner of our neighborhood Halloween costume party, for reference. Oh the horror……

Destra’s Credit Events newsletter will be back after November, to see how credit strategies hold up through the election and Thanksgiving. Hold on, it’s going to be a bumpy ride!