Pursuit of Responsible Alpha®

Investment offerings that strive to provide market leading returns, with an eye towards downside risk, pursue what Destra calls

It requires a great deal of boldness and a great deal of caution to make a great fortune, and when you have got it, it requires ten times as much wit to keep it.

Understanding Responsible Alpha®

To understand the concept of Responsible Alpha® you have to think about the power of compounding and its impact to an investment both up and down in value. Take the following table of returns below, for example:

Total Return Table

| Year | Investment A | Investment B |

|---|---|---|

| 1 | 23% | 15% |

| 2 | 25% | 15% |

| 3 | -30% | -8% |

| 4 | 27% | 16% |

| 5 | 22% | 14% |

| 6 | -27% | -5% |

| 7 | 22% | 13% |

| 8 | 25% | 17% |

| 9 | -13% | -4% |

| 10 | 36% | 19% |

| Average Return | 11% | 9.5% |

If you have a long-term investment horizon, which investment would you choose: Investment A or B?

Investment A which averaged 11% per year

Investment B which averaged 9.5%

Answer

Looking at simple average return, many people might choose Investment A. However, a more careful analysis would lead to selecting

Why is that the case you may ask? Based on mathematics, Investment B would compound at a much higher rate due to less volatility (standard deviation), resulting in a higher Compounded Annual Growth Rate (CAGR).

Read more information about compounding returns.

Total Return Table - The Reality

| Year | Investment A | Investment B |

|---|---|---|

| 1 | 23% | 15% |

| 2 | 25% | 15% |

| 3 | -30% | -8% |

| 4 | 27% | 16% |

| 5 | 22% | 14% |

| 6 | -27% | -5% |

| 7 | 22% | 13% |

| 8 | 25% | 17% |

| 9 | -13% | -4% |

| 10 | 36% | 19% |

| Average Return | 11% | 9.5% |

| Compound Return | 8.2% | 9.0% |

| Standard Deviation | 24.4% | 10.7% |

In order to successfully produce, preserve, and prolong wealth, the key to compounding has more to do with avoiding catastrophic losses than it has do with capturing huge gains.

Responsible Alpha® in Action

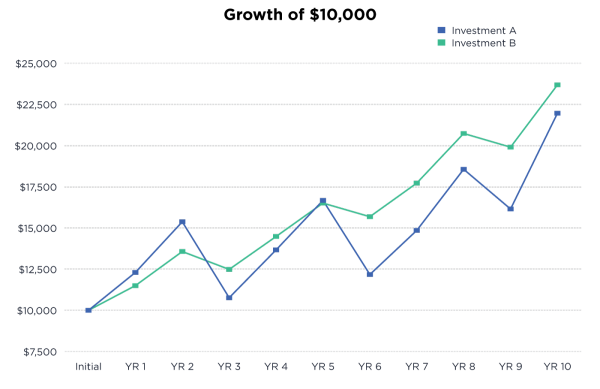

Rothschild knew that the key to protecting and compounding wealth over time was controlling downside risk and volatility. The chart below shows the growth of $10,000 that an investor would obtain when experiencing the total returns listed in the table above.

Lower volatility allows Investment B to compound more wealth in this example.

The examples referenced are for illustrative purposes only and hypothetical in nature. Past performance is not a guarantee of future results.

To further illustrate this point, the graph below shows the importance of limiting downside losses in a portfolio. For example, a portfolio that loses 10% needs to earn 11% just to get back to its starting value. But a portfolio or investment that loses 50% for example, must now experience a 100% return just to get back to even. Take this example out, to an 80% loss and you can see the consequences of negative compounding.

The above is a graphical depiction of the return needed to offset gain/loss.

By attempting to limit the downside and volatility through managing risk, investors may be able to achieve greater performance over the long-term horizon. Most importantly, though, Investors may have the confidence and conviction to stay invested through market downturns, if they experience less volatility.

The Responsible Alpha® Outcome

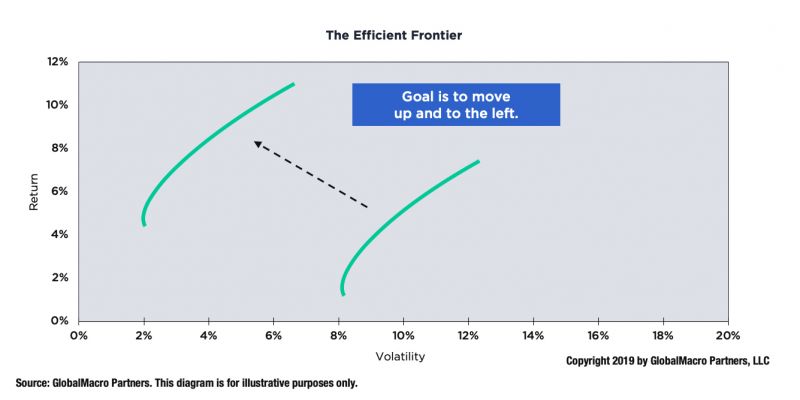

A goal of every investor is often to generate higher portfolio returns with less risk. This is often called “moving up and to the left” on the Efficient Frontier.

At Destra, we call it “Achieving Responsible Alpha®”. Destra believes that one of the best ways to accomplish this is to intelligently diversify a portfolio with multiple investments that have low correlations to traditional stocks and bonds. By partnering with institutional investment managers that share the same belief, we have the ability to offer advisors and clients very unique alternative investment strategies in product agnostic structures – with the end goal in mind of “Achieving Responsible Alpha®”.