Historically Low Correlations... From Preferreds

October 20, 2021

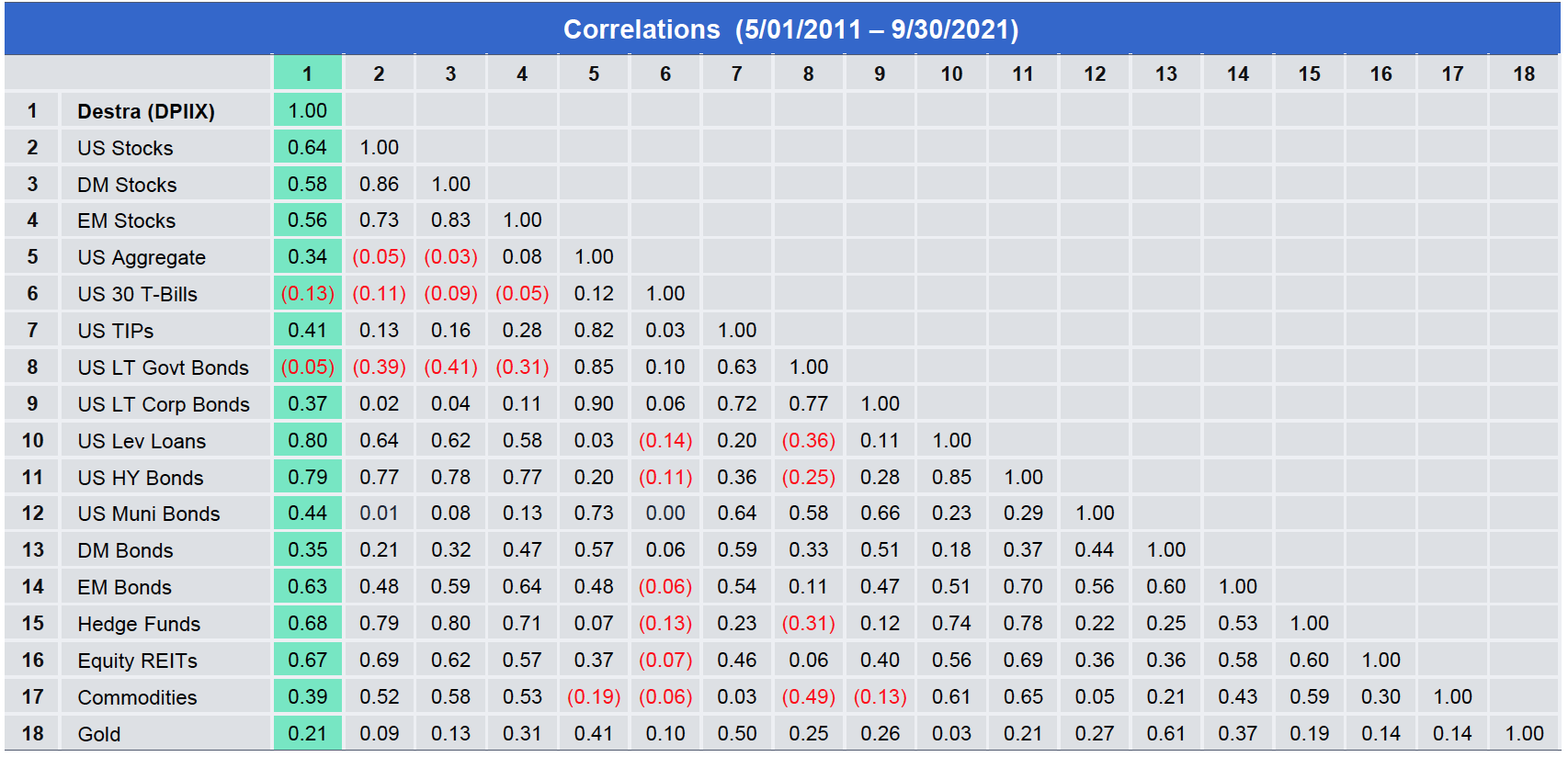

In today's relatively low yield environment, many income seekers are looking for more diversification. The hybrid nature of preferred stocks have historically exhibited low correlations to other major asset classes, making them an attractive diversifier to traditional and non traditional fixed-income asset classes.

The table below shows historical correlation between preferreds and other popular income producing asset classes. Each of these asset classes brings its own risks and potential rewards. Mixing them effectively can help diversify the sources of yield or income in an investor’s portfolio and may help reduce volatility of the portfolio over time.

Source: Morningstar and GlobalMacro Partners, LLC

In additional to the historically low correlations preferreds bring compared to other asset classes, they also offer high yields versus other fixed income securities issued by investment grade companies and can be an excellent diversifier for investors seeking current income potential.

Index Definitions: Preferred Stocks ICE BofAML Fixed Rate Preferred TR US Stocks S&P 500 TR EM Bonds JPM EMBI Plus TR DM Bonds FTSE Citi WGBI non USD TR Muni Bonds Bloomberg Barclays Muni TR US LT Govt Bonds IA SBBI LT Government TR US Sr Loans Credit Suisse Leveraged Loan TR US TIP ICE BofAML US Inflation Linked TR US HY Bonds IA Barclays High Yield Corp TR US Corp IA SBBI LT Corporate TR US Agg Barclays US Aggregate Bond TR US T Bills IA SBBI T Bill TR DM Stocks MSCI EAFE TR EM Stocks MSCI EM TR REITs FTSE NAREIT All Equity TR Gold London PM Spot Gold Commodities S&P GSCI TR Hedge Credit Suisse Hedge Fund Index All information is historical and for illustrative purposes only

Past performance does not guarantee future results.

The examples referenced are for illustrative purposes only and hypothetical in nature. Past performance is not a guarantee of future results.