Interval Fund 101

Destra Capital

July 12, 2023Growth of Interval Fund Marketplace

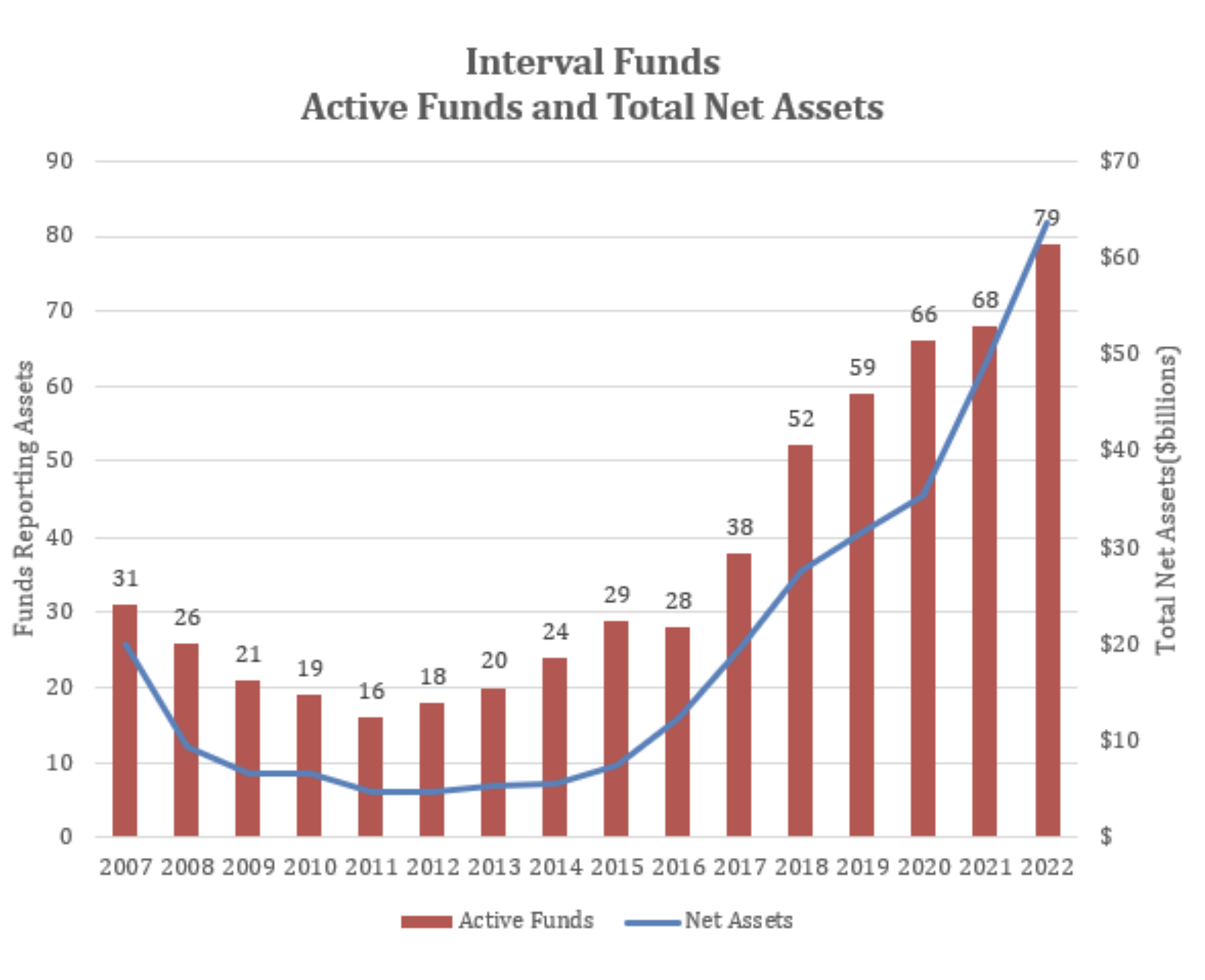

The interval fund marketplace has seen dramatic growth over the last decade. According to Interval Fund Tracker*, there were 79 active interval funds at the end of 2022, up from only 68 funds just a year earlier. Total interval fund net assets have tripled over the past decade, ending 2022 at $63.5 billion, which represents nearly 30% asset growth from the end of 2021 alone.

*Source: Interval Fund Tracker, https://intervalfundtracker.com/2023/02/14/interval-fund-market-keeps-setting-new-records/

What’s driving growth in the interval fund market?

Over the past decade, investors have looked to alternatives to diversify portfolios. Interval funds are uniquely suited to providing access to alternative investments and asset classes including, but not limited to:

- Traded and non-traded real estate investment trusts (REITs)

- Traded and non-traded business development companies (BDCs)

- Traded and non-traded master limited partnerships (MLPs)

- Distressed/stressed credit

- Private credit

- Private equity/venture capital

- Hedge fund strategies

- Infrastructure

- Insurance-linked securities

- Currencies

- Publicly traded stocks and bonds

Where are interval fund assets by category?

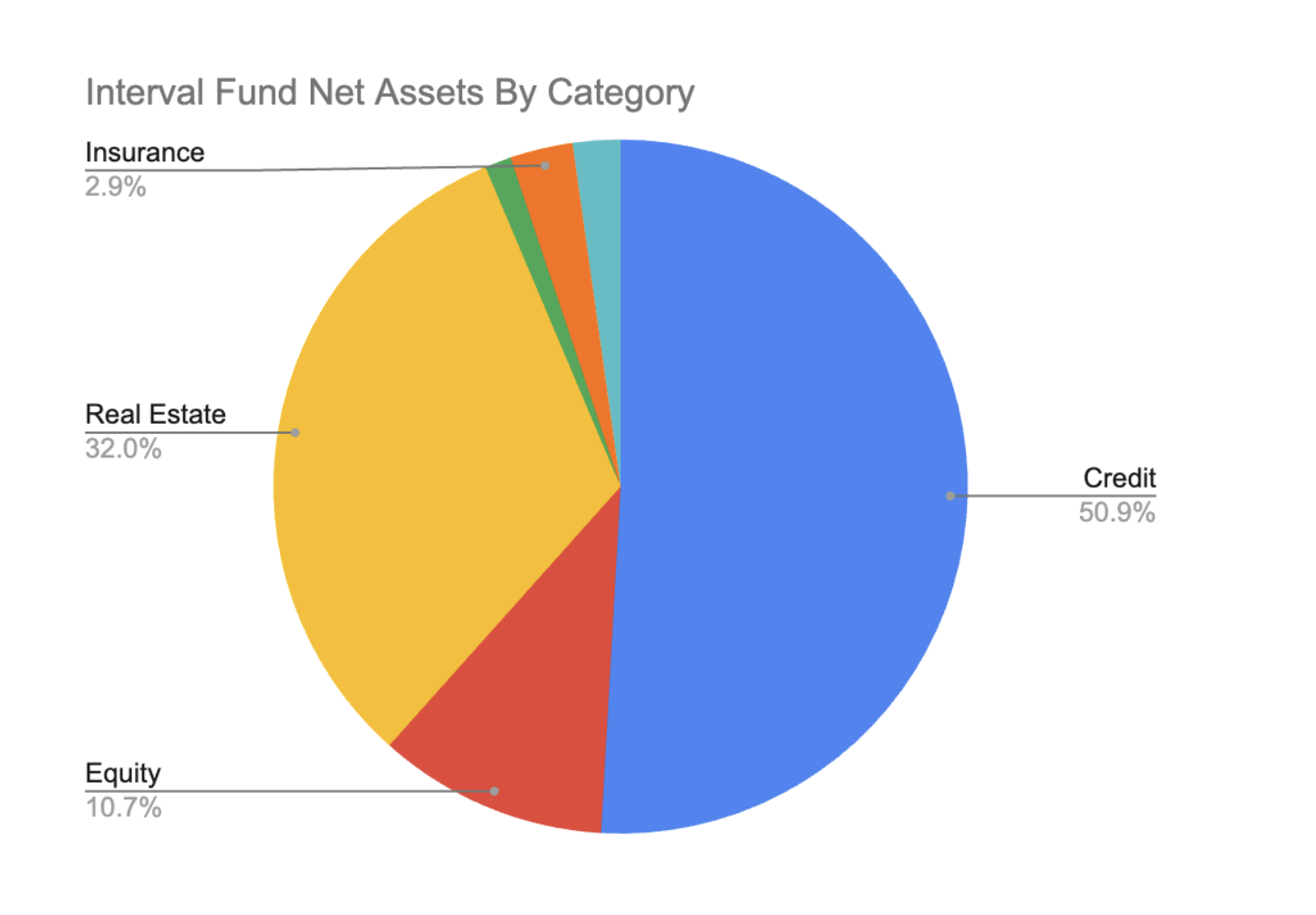

As of June 2023, over half (50.9%) of interval fund assets are grouped in the Credit category and 32% of assets are invested in Real Estate. The remaining category groups were Equity (10.7%), Insurance-linked securities (2.9%), Private Equity/Venture Capital (2.2%), and Multistrategy (1.2%).

Source: Interval Fund Tracker, https://intervalfundtracker.com/data/active-interval-funds/

What is an Interval Fund?

An interval fund is a fund structure that is being rediscovered by both asset managers and investors. It is technically classified as a “closed-end” fund under the Investment Company Act of 1940 (“‘40 Act”) and while it may take in new investments daily, it only allows redemptions or repurchases at specified intervals, most commonly 5% each quarter. This key differentiator -- specified liquidity intervals -- allows asset managers to know the maximum amount that might potentially be withdrawn at each interval and thus allows the managers to hold illiquid or less liquid assets without fear of excess short-term redemptions.

Other differentiators of interval funds are:

- They provide investors with the ability to invest in liquid (marketable) and non-liquid (non-marketable) investments.

- They can invest some or nearly all of a portfolio into illiquid investments while the quarterly interval redemption program provides potential flexibility for investors to access their capital.

- Their shares typically do not trade on the secondary market. Instead, their shares are subject to periodic repurchase offers by the fund at a price based on net asset value.

- They are permitted to continuously offer their shares at a price based on the fund’s net asset value (and many do).

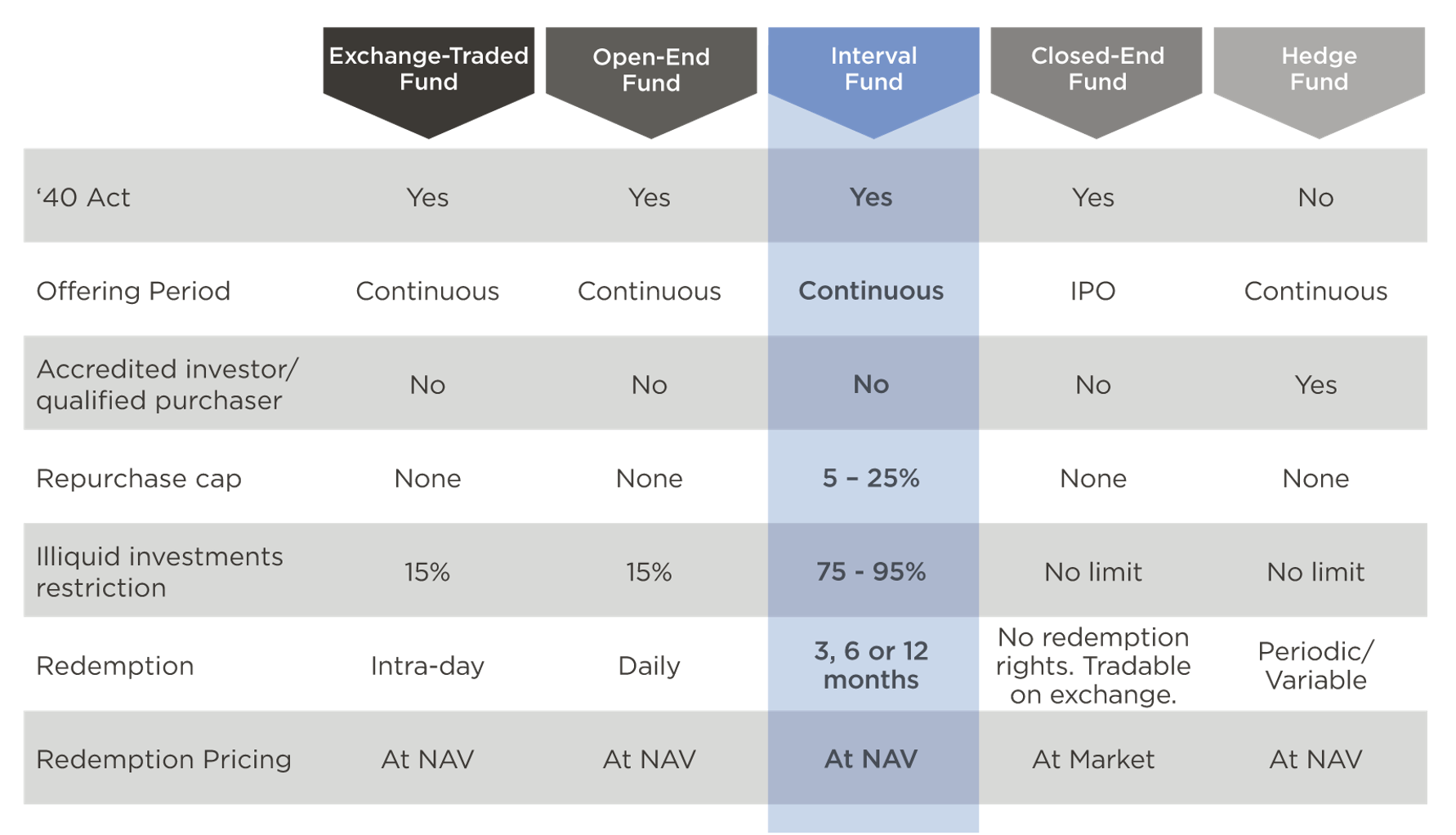

The table below provides a brief comparison of various structures:

- Interval funds allow limited liquidity (5 – 25%) and the ability to invest in illiquid or less liquid investments, much like hedge funds, but with the structure and protections of the ‘40 Act.

- Exchange listed closed-end funds also provide for the use of illiquid investments, but investors’ purchase and sale is subject to market prices on the exchange which can be significantly different (premium or discount) to the fund’s NAV.

- Open-end and exchange-traded funds are limited to 15% in illiquid investments. Interval funds occupy an attractive middle ground between daily vehicles, which have tight restrictions on less liquid assets, and hedge funds, which have less uniform or regulated formats.

Potential Advantages of Interval Funds

- Active management across multiple assets classes and investments adds increased diversification

- Greater ability to invest in less liquid assets such as stressed/distressed credit, private credit, non-traded REITs, BDCs, MLPs, and private equity/venture captial

- Access to investments that may only be available to accredited investors*

- Potentially higher yields

- Ability to increase exposure to a variety of alternative asset classes without large capital commitments and increased liquidity

- Potential reduction of “investment headline” risk**

- Potential to dilute the negative impact of a particular investment within the fund

*Investors who are financially sophisticated and have a reduced need for the protection provided by certain government filings. See www.sec.gov for further explanation.

**The possibility that a news story will adversely affect a stock’s price.

Potential Disadvantages

- Limited liquidity (usually limited to quarterly or annual redemptions)

- Potential lack of detailed transparency from some private or illiquid investments

- Potentially higher internal fee structure versus other types of funds

What are the liquidity rules and redemption policies associated with interval funds?

An interval fund will make periodic repurchase offers to its shareholders, generally every three, six, or twelve months, as disclosed in the fund’s prospectus and annual report. The interval fund will also periodically notify its shareholders of the upcoming repurchase dates. When the fund makes a repurchase offer to its shareholders, it will specify a deadline date by which shareholders must make their repurchase/redemption request. The actual repurchase will occur at a later, specified date, often shortly after the repurchase deadline date.

The price that shareholders will receive on a repurchase will be based on the per share NAV determined as of the specified (and disclosed) date. This pricing date will occur sometime after the close of business, often on the deadline date by which shareholders must submit their repurchase request.

Who should invest in interval funds?

Interval funds are designed specifically for investors with a moderate-to-high risk tolerance, a mid-to long-term time horizon, and ample liquidity elsewhere in their portfolio, due to the nature of the quarterly redemption intervals and underlying investments.

Investors seeking to diversify their portfolio to alternative investment strategies may benefit from the an interval fund’s diversified approach.

Interval funds are complex investment instruments that can contain a variety of investment types. Before investing in interval funds, investors should understand the liquidity features and characteristics of the underlying investments. Investors should work closely with their financial advisors to determine if interval funds are suitable for their portfolios and economic situations.

How can interval funds be used in a portfolio?

- Interval funds can be used to gain access to investments, assets, and trading strategies that investors may not normally have access to due to accreditation requirements.

- Since the investments held in interval funds are usually less liquid than those held in other types of funds and are concentrated in alternative asset classes, they must be used carefully.

- Investors are encouraged to consult their financial advisor to determine which types of interval funds and focuses are most appropriate for a given portfolio (as everyone's economic and personal situation vary).

- Interval funds are commonly used to gain exposure to alternative sectors of the market. Frequently, they are used as the “satellite” or “explore” component of a “core & explore” portfolio, where the core is typically made up of more traditional stock and bond exposures.

- Investors using interval funds in combination with other alternative investments may achieve greater diversification, lower risk, and increased liquidity over a portfolio solely consisting of illiquid alternative investments and direct participation programs.

A Manager’s Perspective on Closed-End Interval Funds

“Only five or six years ago, the interval fund structure was brought to our attention, by Destra. There isn’t such a structure in Europe, believe it or not, even to this day. What the interval fund does nicely for stressed and distressed investing is, it provides a flexible framework for investor withdrawals without compromising the managers ability to take full advantage of the opportunity set. So, our average hold period for an investment is probably anywhere between three months and let’s say 24 months. And that quite nicely matches in the liquidity profiles that we’re providing investors within the interval fund. So, there’s many parts or aspects of the interval fund structure that we actually think are really very well suited for the distressed, special situation credit asset class that we’re investing in. And as investors in Europe start to learn about this, there’s a lot of chat about how we can develop similar products over this side of the ocean as well.”

- Duncan Farley, Portfolio Manager, RBC BlueBay Asset Management

From a fund manager’s viewpoint, interval funds possess a number of desirable characteristics:

- Interval funds enhance the ability for investors to earn an “illiquidity premium”:

One key advantage of the structure is the ability for an asset manager to expose investors to less liquid opportunities which may offer higher long-term returns. As the structure gives the manager visibility on the maximum potential outflow, less liquid opportunities can be held without fear of having to sell unexpectedly at unattractive prices. - Advantageous for liquid opportunities with longer time horizons:

Fund managers often have ideas which take months, or longer, to play out. These opportunities can be in liquid securities, though time horizon is required to maximize the gain. The interval fund structure facilitates managers incorporating these opportunities in the knowledge they are unlikely to have to be sold prematurely. - Longer-term investment vehicles:

Many investors have a tendency to sell when prices decline, crystalizing losses and increasing transaction costs. Interval Funds, with their periodic redemptions windows, encourage investors to take a longer term perspective, which is usually more consistent with their investment horizon.

There are risks involved with any investment. The principal risks associated with an investment in the Fund, which could adversely affect its net asset value, yield and return, are set forth below. Please see the section “Further Information About Principal Risks” in the Prospectus for a more detailed discussion of these risks and other factors you should carefully consider before deciding to invest in the Fund. An investment in the Fund may lose money and is not a deposit of a bank or insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Investment Strategy Risk: The Investment Adviser uses the Fund’s principal investment strategies and other investment strategies to seek to achieve the Fund’s investment objective of long-term growth of capital. There is no assurance that the Investment Adviser’s investment strategies or securities selection method will achieve that investment objective. Because of the risks associated with investing in high-yield securities, an investment in the Fund should be considered speculative. An investment in interval Funds involves a high degree of risk. In particular: The fund’s shares will not be listed on an exchange in the foreseeable future, if at all. It is not anticipated that a secondary market for shares will develop and an investment in an interval fund is not suitable for investors who may need the money they invest within a specified time frame. Interval Funds are suitable only for investors who can bear the risks associated with the fund’s limited liquidity and should be viewed as a long- term investment. The amount of distributions that the fund may pay, if any, is uncertain. The fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the fund’s performance, such as a return of capital, borrowings or expense reimbursements and waivers. Interval funds may use leverage which may cause a portfolio to liquidate positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. Leverage, including borrowing, may cause a portfolio to be more volatile than if the portfolio had not been leveraged.